Reduce your tax bill before 30 June 2020

What to do when your supply chain faces disruption

If your company relies on suppliers in various geographic locations, it’s likely that your business will face a supply chain disruption. Whether that disturbance is caused by a virus, like Covid-19, regulatory lock-down, international tensions, changes in local laws or a natural disaster, there will probably be scenarios in which your suppliers or transporters face […]

JobKeeper – “Identify” wage subsidy to be claimed

By now, your eligible business will have enrolled for JobKeeper. If not, you have until 8 May 2020 to do so – see our previous post for more info. It’s now time for the next step: IDENTIFY Log into the ATO Business Portal Click “Identify” (the form to identify and maintain eligible employees, for JobKeeper […]

JobKeeper Payment: Enrol by 30 April 2020 [UPDATE: Extended to 8 May 2020]

As of Monday 20 April 2020, eligible businesses can now enrol for the JobKeeper payment. You must do this by 30 April 2020 to claim JobKeeper payments for April. The ATO have extended the date that you must to this by to 8 May 2020, in order to claim JobKeeper payments for April 2020. You […]

JobKeeper – The Next Step

You’ve already heard about JobKeeper. If not check out our first JobKeeper blog post You’ve already ascertained whether or not JobKeeper applies to you/your employees and and adjusted your pay templates. If not check out our second JobKeeper blog post What next? Send the ‘JobKeeper Employee Nomination Notice’ to all eligible employees and […]

Covid-19 & working from home: What expenses can you claim?

Covid-19 is changing so much in our lives. A lot of you are now working from home, when you weren’t previously. A logical question then becomes: What expenses can I claim, now that I’m working from home? We’ve got you covered… Calculating running expenses There are three ways you can choose to calculate your additional […]

TO ALL BUSINESS OWNERS WHO EMPLOY STAFF (JobKeeper)

JobKeeper or not? By now you should have ascertained whether or not your business qualifies for the new JobKeeper Assistance package. If so, you should have registered your intent, with the Australian Taxation Office, and received your text reply. What you need to do from 30 March 2020 As advised in our previous post, […]

JobKeeper Payment (Covid-19 Stimulus Package update)

Last night saw the next stage of the Federal Governments economic relief package – JobKeeper Payment. EMPLOYERS In short eligible employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months. Eligible Employers are those where: their business has a turnover […]

Important Stimulus Package Update

Our Office Our office is remaining open to all queries. We are postponing face to face meetings, however we are still able to provide advice remotely via email, phone or video conferencing. Important Stimulus Package Update Cashflow assistance for businesses: ATO Credit of up to $100,000 for PAYG-Withholding This is an extension of the previously […]

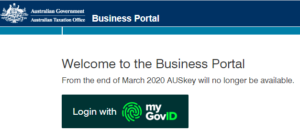

A reminder for our clients that use the ATO Business Portal: myGovID & RAM

A reminder for our clients that use the ATO Business Portal: ‘myGovID’ and ‘RAM’ will replace ‘AUSkey’ and ‘Manage ABN Connections’ at the end of March 2020. We recommend creating a myGovID sooner, rather than later, in order to fully familiarise yourself by the time AUSkey retires. myGovID Not to be confused with your […]